Gold Today Price: Global Market Trends and Insights

Gold’s price is a hot topic. It affects savings, investments and long-term wealth security. Many people check gold prices every day. They do this to make smart choices, especially during inflation, currency changes, and economic uncertainty. I personally started tracking gold prices regularly after seeing how quickly market conditions changed during global economic shifts. That habit helped me understand why gold still holds strong value across generations.

Gold prices do not move randomly. They respond to inflation data, interest rate decisions, geopolitical tension and currency strength. When uncertainty rises, gold demand increases, pushing prices upward. This article clearly explains gold pricing. It compares global markets and offers real-world insights to help you understand forecasts.

- Gold acts as a hedge against inflation.

- Prices fluctuate due to global economic signals.

- Long-term tracking improves investment timing.

Understanding Gold Today Price in the Global Market

Today’s gold price depends on global supply, investor sentiment and currency changes. The US dollar plays a major role because gold trades internationally in USD. When the dollar weakens, gold prices often go up. This makes gold more appealing to buyers around the world.

In my experience, gold prices usually change before big economic news is released. That early movement usually signals upcoming market shifts. This behaviour makes gold a reliable indicator of financial stability across markets.

- Global demand influences daily pricing.

- Currency strength impacts gold value.

- Market sentiment drives short-term changes.

Gold Price in USA: Market Behaviour and Trends

The gold price in the USA is a global benchmark. This is because most trading happens there. US inflation reports, Federal Reserve policies, and employment data affect gold prices.

When interest rates rise, gold sometimes slows because investors prefer yield-based assets. However, during financial uncertainty, gold demand increases sharply in the U.S. market. I have seen investors shift to gold during stock market volatility, especially during economic slowdowns.

- Federal Reserve decisions impact gold prices.

- Inflation data drives investor demand.

- Gold remains a safe-haven asset.

Gold Price in UK: Economic Signals and Demand

The Gold Price in UK depends heavily on pound strength and economic stability. UK investors often turn to gold during political uncertainty or inflation pressure. When the pound weakens, gold prices rise locally even if global rates stay stable.

I noticed UK gold prices moving quickly after major policy announcements. This pattern highlights gold’s role as a financial safety net. Long-term UK investors rely on gold for wealth preservation rather than short-term gains.

- Pound strength affects gold pricing.

- Political stability influences demand.

- Gold supports long-term savings.

Gold Price in India: Cultural and Investment Value

The Gold Price in India holds cultural, emotional and financial importance. Indian demand increases during wedding seasons and festivals, which directly impacts pricing. Import duties and currency exchange rates also affect gold prices locally.

From observing Indian markets, gold buying remains consistent even during price rises. People trust gold as a family asset passed down across generations office 365 consulting. This demand stability keeps gold strong even during economic slowdowns.

- Festival demand raises prices.

- Import taxes affect local rates.

- Gold serves cultural and financial roles.

Gold Price UAE: Regional Trading Hub

The Gold Price UAE attracts global buyers due to low taxes and high purity standards. Dubai serves as a gold trading hub. It offers competitive prices compared to many countries.

I noticed that travellers often buy gold in UAE markets. They like the clear pricing. The strong regulatory environment builds trust among buyers and investors.

- Tax advantages attract buyers.

- High purity standards maintained.

- UAE remains a gold trading hub.

Gold Price in Canada: Investment Stability

The gold price in Canada closely matches global rates. It also reacts to changes in the local currency. Canada’s strong mining industry also influences gold supply and investor confidence.

Canadian investors view gold as portfolio insurance. During economic uncertainty, gold demand increases steadily across Canada, maintaining price resilience.

- Currency strength impacts pricing.

- Mining industry supports supply.

- Investors seek portfolio balance.

Gold Price in Saudi Arabia: Market Influence

The gold price in Saudi Arabia relies on several factors. These include oil prices, currency stability and global demand. Saudi investors often choose gold for wealth protection rather than speculation.

Gold demand increases when the economy is uncertain. This strengthens gold’s role as a stable asset in the region.

- Oil prices affect market sentiment.

- Currency stability supports demand.

- Gold protects long-term wealth.

Gold Price Calculator: How to Estimate Value

A Gold Price Calculator lets buyers quickly check the current value of gold. It uses weight and purity for accurate estimates. This tool removes confusion and ensures transparency during purchases.

I personally use calculators before making any gold-related decisions. It helps avoid overpaying and improves buying confidence.

- Calculates real-time value.

- Considers purity and weight.

- Improves buyers’ confidence.

Gold Price Predictions and Forecast Analysis

Gold Price Predictions rely on inflation trends, interest rates and global uncertainty. Analysts often use historical patterns to estimate future movement. Current data suggests gold will remain strong during economic volatility.

Based on my tracking, gold prices rarely crash suddenly. Instead, they adjust gradually, making long-term holding a safer strategy.

- Inflation boosts gold demand.

- Interest rates influence movement.

- Long-term outlooks remain stable.

Gold Price Forecast Table Comparison

| Country | Average Price Trend | Market Influence |

| USA | High Volatility | Federal Reserve |

| UK | Moderate | Pound Strength |

| India | High Demand | Cultural Buying |

| UAE | Competitive | Tax Benefits |

| Canada | Stable | Mining Supply |

| Saudi Arabia | Consistent | Oil Economy |

FAQs About Gold Today Price

What determines gold today price?

Global demand, inflation, currency strength and interest rates determine gold prices.

Is gold a good long-term investment?

Yes, gold preserves its value during inflation and economic uncertainty.

Why do gold prices vary by country?

Taxes, currency exchange rates and local demand cause variation.

How often do gold prices change?

Gold prices change multiple times daily based on market activity.

Conclusion

Gold today price remains a critical indicator of global financial health. Gold protects wealth, balances portfolios and offers stability during uncertainty. Tracking gold prices daily improves decision-making and investment timing. My personal experience confirms that informed gold buying reduces risk and increases confidence. Gold continues to stand strong as a trusted asset worldwide.

For more…. Click here.

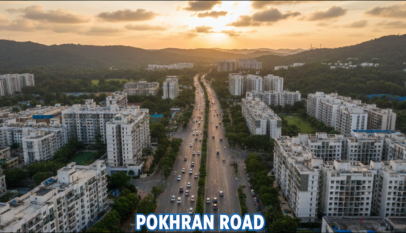

Premium Residential Properties on Pokhran Road Thane | Location, Connectivity & Investment Guide

Thane has witnessed remarkable real estate growth over the past decade, and Pokhran Road s…