Lending teams feel pressure from both sides. Volumes continue to rise, while expectations regarding accuracy and risk review become increasingly stringent. At the same time, analyst time does not expand. Many delays do not stem from hard credit calls, but rather from slow preparation, rework, and unclear data.

This blog explains how smarter systems change that pattern. You will see how lending teams move faster without cutting corners, how reviews become clearer, and how daily credit work shifts from mechanical effort to informed judgment.

How Bank Spreading Software Enables Smarter Lending

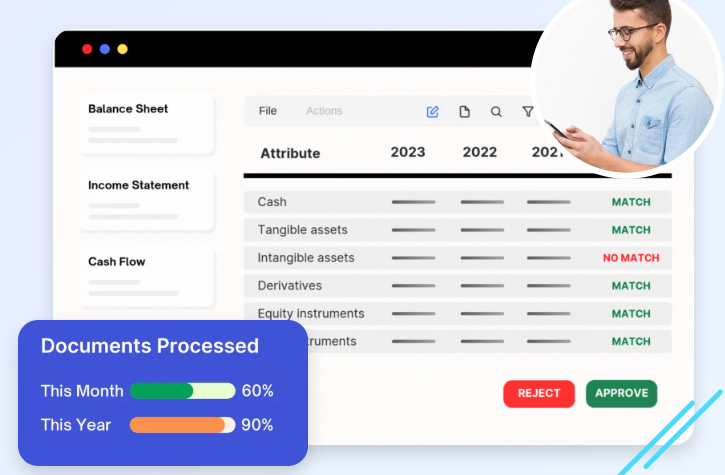

Let us take a closer look at how lending teams improve speed and decision quality when structured systems, such as bank spread software, replace manual processes. Below are some ways modern workflows change analyst focus, review quality, and overall confidence in credit.

Faster Statement Processing Without Rushing Analysis

When you begin a review, the first hurdle often has nothing to do with risk. You sort statements, align periods, and fix formats before any analysis starts. Bank spreading software removes much of that friction by pulling data into a consistent structure from the start. Instead of rebuilding layouts, you open a file that already follows your lending logic.

This change alters how time is utilized. Preparation shrinks, and review expands. You spend more of the day studying trends, margins, and cash flow instead of repairing formulas. Turnaround improves, yet the work feels calmer because you are not racing against setup delays.

Clearer Financial Comparisons Across Borrowers

Consistency shapes understanding. When every borrower file follows the same structure, comparisons become easier to spot. You track revenue movement across periods without having to hunt for line items. You see expense behavior without second-guessing categories.

Clear layouts also help during reviews. Managers scan results faster because they know where to look. Questions become sharper since everyone sees the same picture. Over time, this clarity supports better benchmarking across industries and portfolios. You spend less effort decoding files and more effort evaluating strength and risk.

Better Use of Analyst Judgment

Manual spreading pulls analysts into repetitive tasks. That work fills hours without using much judgment. Automation shifts attention back to thinking. You study cash cycles, seasonality, and sustainability. You question assumptions instead of correcting layouts.

This shift changes how analysts feel about the work. Engagement improves because effort connects to decisions. Credit memos become stronger because they focus on drivers, not cleanup notes. Judgment gains room to develop, which matters most in borderline or fast-moving deals.

Lending Outcomes That Improve Beyond Speed

Let’s take a look at how these workflow changes impact lending results over time. Below are some broader impacts that show up in collaboration, consistency, and portfolio oversight.

Fewer Errors and Cleaner Credit Files

Errors often slip in during manual handling. A broken formula or misaligned category can have a ripple effect throughout a review. Automated systems reduce that risk by maintaining stable mappings. Numbers flow through set rules instead of ad hoc fixes.

Cleaner files shorten review cycles. You spend less time tracing where a value came from. External reviews move faster because documentation stays consistent. These gains repeat every cycle, which adds up quietly but steadily.

Smoother Collaboration Across Credit Teams

Credit work touches many roles. Analysts prepare spreads. Managers review them. Committees discuss outcomes. When files vary, collaboration slows. Standard outputs smooth those handoffs.

Managers trust the base data. Underwriters focus on structure and exposure. Committees ask fewer clarification questions because numbers align across reports. You notice fewer revisions moving back and forth. Work feels coordinated rather than fragmented.

More Consistent Lending Decisions Over Time

Consistency supports fairness. When data enters reviews the same way each time, decisions rely less on who prepared the file and more on the borrower profile. This steadiness helps banks manage risk across cycles.

Over time, consistent data support portfolio oversight. Trends emerge more clearly. Policy alignment improves. During audits or regulatory checks, teams can explain their decisions with confidence because the data story remains intact.

Day-to-Day Workflow Changes Analysts Notice

- Reviews start sooner because the setup takes less time. You move straight into review instead of fixing formats or tracking missing data.

- Files require fewer adjustments between teams. Each handoff feels smoother because everyone follows the same structure.

- Analysis feels calmer, not rushed. You spend more time thinking through trends instead of racing against deadlines.

- Planning becomes easier during peak periods. Workloads feel predictable, which helps teams balance effort across busy weeks.

These changes may seem small on their own. Together, they reshape how lending teams work week after week.

Conclusion

Smarter lending depends on how clearly teams can see the financial story behind each borrower. As volumes rise and timelines become tighter, manual effort becomes increasingly difficult to justify.

Bank spreading software supports a steadier way forward by reducing setup work, improving clarity, and giving analysts space to think. Over time, that space leads to better judgment, stronger collaboration, and lending decisions shaped by insight rather than pressure.

Discover Modern Comfort: A Guide to Apartment Rent in Beirut

Beirut, the lively capital of Lebanon, is a city that blends deep-rooted history with a mo…