In today’s fast-paced digital ecosystem, businesses are increasingly required to verify customer identities quickly, securely, and in compliance with global regulations. An identification verification service combined with digital KYC verification has become the backbone of secure onboarding across industries such as fintech, banking, insurance, e-commerce, and telecom. These solutions not only prevent fraud but also help businesses deliver a seamless and trustworthy user experience.

What Is an Identification Verification Service?

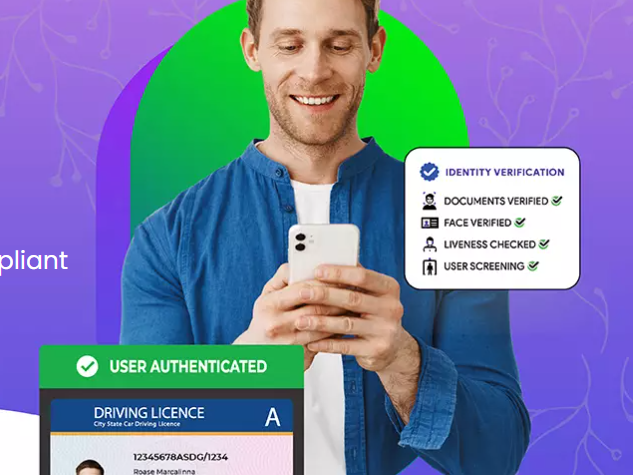

An identification verification service is a technology-driven process that validates a person’s identity using official documents, biometric data, and real-time verification checks. Instead of relying on manual reviews, businesses use automated systems to confirm whether a customer is genuine.

This process typically involves document verification, identity data extraction, facial verification, and database checks. By implementing a reliable identification verification service, organizations can significantly reduce identity theft, impersonation, and account takeover fraud.

Understanding Digital KYC Verification

Digital KYC verification (Know Your Customer) is the modern, paperless version of traditional KYC procedures. It enables businesses to verify customers remotely using digital tools such as mobile devices, AI algorithms, and cloud-based platforms.

Unlike offline KYC, digital KYC verification allows customers to complete identity checks in minutes. Users simply upload their identity documents and perform a quick biometric verification, making the onboarding process faster and more convenient while remaining compliant with regulatory requirements.

Key Components of Digital KYC Verification

A robust digital KYC verification solution generally includes:

-

Document Verification: Validates government-issued IDs such as passports, Aadhaar cards, driver’s licenses, or national ID cards.

-

Facial Verification: Matches the user’s selfie with the photo on the identity document.

-

Liveness Detection: Confirms that the user is physically present and not using a spoofed image or video.

-

Data Validation: Cross-checks user information with trusted databases to ensure accuracy and authenticity.

Together, these components create a secure and reliable identification verification service.

Benefits of Identification Verification Services

Implementing an advanced identification verification service offers multiple benefits for businesses:

-

Fraud Prevention: Stops fake identities, document forgery, and identity fraud at the onboarding stage.

-

Regulatory Compliance: Helps meet AML and KYC regulations across different regions.

-

Faster Customer Onboarding: Reduces verification time from days to minutes.

-

Cost Efficiency: Minimizes manual verification costs and operational overhead.

-

Improved Customer Trust: Builds confidence by ensuring secure and transparent processes.

Why Businesses Need Digital KYC Verification Today

As digital transactions increase, so do cyber threats and financial crimes. Regulatory authorities worldwide now mandate strict KYC compliance, making digital KYC verification essential rather than optional. Businesses that fail to adopt secure identification verification services risk penalties, reputational damage, and customer churn.

Digital KYC verification also supports scalability. Whether a business is onboarding hundreds or millions of users, automated identity verification systems ensure consistent accuracy without compromising speed or security.

Use Cases Across Industries

Identification verification services and digital KYC verification are widely used in:

-

Banking and Fintech for account opening and loan approvals

-

Insurance for policy issuance and claim verification

-

E-commerce for seller and buyer verification

-

Telecom for SIM card activation

-

Healthcare for patient identity validation

Conclusion

In an increasingly digital world, secure and efficient identity verification is critical for business growth and customer trust. An advanced identification verification service combined with digital KYC verification empowers organizations to onboard users seamlessly, prevent fraud, and stay compliant with evolving regulations. By investing in the right digital identity solutions, businesses can create a safer, faster, and more reliable digital ecosystem for everyone.

Discover Modern Comfort: A Guide to Apartment Rent in Beirut

Beirut, the lively capital of Lebanon, is a city that blends deep-rooted history with a mo…