India HVAC Systems Market Size and Forecast Analysis 2026–2034

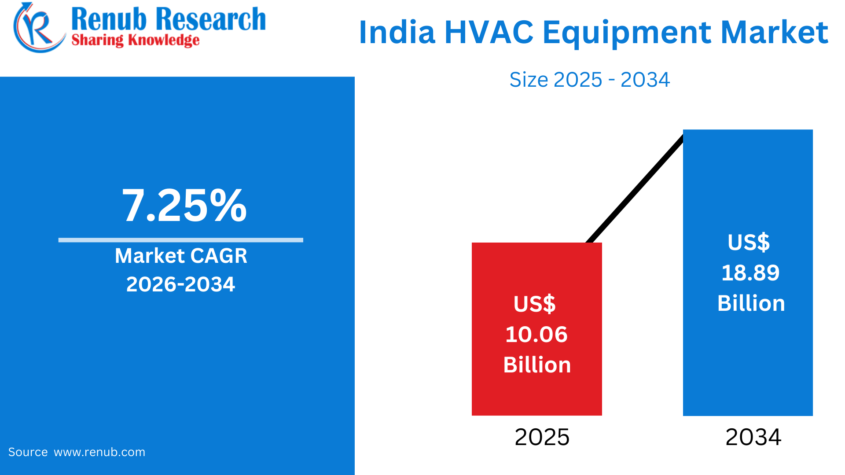

According to Renub Research India HVAC (Heating, Ventilation, and Air Conditioning) systems market is poised for sustained and stable growth over the forecast period, supported by rapid urbanization, large-scale infrastructure development, rising disposable incomes, and increasing awareness of energy efficiency and indoor air quality. The market is projected to expand from US$ 10.06 billion in 2025 to US$ 18.89 billion by 2034, registering a compound annual growth rate (CAGR) of 7.25% during 2026–2034.

India’s diverse climate conditions, characterized by long hot summers and high humidity levels across most regions, have made HVAC systems an essential component of modern living rather than a luxury. The growing construction of residential complexes, commercial buildings, healthcare facilities, data centers, and transportation infrastructure is significantly accelerating HVAC adoption. In parallel, government initiatives focused on energy efficiency, sustainability, and green buildings are reshaping technology choices across the sector, further strengthening market prospects.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=india-hvac-equipment-market-p.php

India HVAC Systems Market Outlook

HVAC systems refer to technologies designed to regulate indoor temperature, humidity, ventilation, and air quality to create healthy and comfortable indoor environments. These systems are widely deployed across residential homes, offices, shopping malls, hospitals, factories, hotels, airports, and transportation systems. Key HVAC components include air conditioners, heat pumps, furnaces, chillers, boilers, air handling units, ventilation fans, dehumidifiers, and air purification systems.

The adoption of HVAC systems in India has increased substantially over the past decade, driven by accelerating urbanization, rising per capita income, and changing lifestyle expectations. Cooling solutions, particularly air conditioners, have witnessed strong growth due to India’s tropical climate and rising heat stress in urban areas. In addition, the rapid expansion of commercial real estate, IT parks, data centers, hospitals, and retail complexes has significantly boosted demand for large-scale and centralized HVAC installations.

Government-led initiatives promoting energy efficiency, green buildings, and sustainable urban development are playing a critical role in shaping the HVAC market. Programs encouraging the use of energy-efficient appliances, combined with growing awareness of indoor air quality and health—especially after the pandemic—have increased demand for advanced ventilation and air purification systems. As India continues its journey toward smart cities and sustainable infrastructure, HVAC systems are becoming an integral part of national development.

Growth Drivers in the India HVAC Systems Market

Rapid Urbanization and Infrastructure Development

Rapid urbanization is one of the most significant drivers of growth in the Indian HVAC systems market. India’s urban population is projected to grow from around 500 million to nearly 820 million by 2047, creating enormous demand for climate-controlled indoor environments. Large-scale development of residential housing, commercial offices, metro rail systems, airports, shopping malls, hotels, and institutional buildings is underway across the country.

Air conditioning and ventilation systems have become essential components of new construction projects, particularly in urban and semi-urban areas. Government-backed infrastructure initiatives, including smart city projects and airport expansion programs, are further accelerating HVAC adoption. The increasing number of airports, metro stations, and transport hubs requires advanced HVAC systems to ensure passenger comfort, air quality, and energy efficiency, thereby contributing significantly to market growth.

Increasing Demand for Energy-Efficient and Green Buildings

Energy efficiency has emerged as a core driver of HVAC system adoption in India. Rising electricity costs, growing environmental concerns, and national sustainability goals are encouraging consumers and developers to invest in energy-efficient HVAC technologies. Advanced solutions such as inverter-based air conditioners, variable refrigerant flow (VRF) systems, energy-efficient chillers, and intelligent HVAC controls are gaining widespread acceptance.

India’s strong performance in global green building rankings reflects this shift. The growing number of Leadership in Energy and Environmental Design (LEED) certified projects highlights the country’s commitment to sustainable construction practices. Green buildings prioritize energy-efficient HVAC systems as a key element in reducing carbon emissions and operational costs. As energy efficiency becomes a regulatory and commercial necessity, demand for advanced HVAC systems continues to rise across residential, commercial, and industrial segments.

Increasing Awareness of Indoor Air Quality and Health

Rising awareness of indoor air quality (IAQ) and its impact on health is another important growth driver for the Indian HVAC market. High pollution levels in major cities have intensified concerns about respiratory health, particularly in residential, commercial, and public buildings. Post-pandemic health consciousness has further increased the focus on proper ventilation, air circulation, and filtration systems.

Healthcare facilities, educational institutions, offices, and commercial spaces are increasingly adopting HVAC systems with integrated air purification and advanced filtration technologies. Consumers are seeking affordable solutions that provide cleaner and healthier indoor environments. Government-backed initiatives supporting indigenous development of air purification technologies underscore the growing importance of IAQ, further supporting HVAC market growth.

Challenges in the India HVAC Systems Market

High Installation and Maintenance Costs

High initial installation and ongoing maintenance costs remain a key challenge in the Indian HVAC market. Advanced HVAC systems require significant investment in equipment, installation, electrical infrastructure, and skilled labor. For small businesses and cost-sensitive residential users, these upfront expenses can act as a barrier to adoption.

Additionally, maintenance and operating costs, including energy consumption and periodic servicing, increase the total cost of ownership. In price-sensitive markets such as India, these factors can delay replacement cycles and slow adoption of high-end HVAC technologies, particularly in smaller cities and rural areas.

Lack of Skilled Labor and Infrastructure Constraints

The shortage of skilled HVAC professionals is another major challenge facing the industry. Efficient design, installation, and maintenance of HVAC systems require trained technicians and engineers, who are not uniformly available across India. Poorly installed systems can lead to energy inefficiencies, frequent breakdowns, and higher operating costs.

Infrastructure challenges such as inconsistent power supply in certain regions also impact HVAC performance and reliability. Addressing skill gaps through training programs and strengthening supporting infrastructure will be essential to ensure sustainable growth of the HVAC market across diverse regions of India.

Indian Heat Pump Systems Market

The heat pump systems segment in India is gaining momentum as demand rises for energy-efficient and environmentally friendly heating and cooling solutions. Heat pumps are significantly more efficient than conventional heating systems, as they transfer heat rather than generate it. In India, heat pumps are increasingly used for water heating, space heating in cooler regions, and integrated heating and cooling in commercial buildings.

Rising electricity costs, growing awareness of carbon reduction, and supportive government policies focused on energy efficiency are boosting demand for heat pump systems. As sustainability becomes a priority in both residential and commercial construction, heat pumps are expected to play an increasingly important role in India’s HVAC ecosystem.

India Air Purifier Market

The air purifier segment is one of the fastest-growing components of the Indian HVAC market. Rising pollution levels in urban areas have heightened public awareness of the risks associated with poor air quality. Modern air purifiers equipped with advanced filtration technologies are becoming increasingly common in homes, offices, and commercial establishments.

Post-pandemic health awareness has further accelerated adoption, particularly among families with children and elderly members. Air purifiers are no longer viewed as luxury products but as essential health devices. As awareness of respiratory health and preventive care grows, the air purifier market in India is expected to expand rapidly.

India Residential HVAC Systems Market

The residential HVAC segment is experiencing strong growth due to urbanization, rising disposable incomes, and evolving lifestyle expectations. Air conditioning systems dominate this segment, with increasing adoption in apartments, villas, and high-rise residential complexes. Consumers are increasingly prioritizing energy efficiency, low noise levels, and improved indoor air quality.

Inverter-based and split air conditioning systems have gained widespread popularity due to their energy efficiency and precise temperature control. Growing awareness of comfort, health, and environmental sustainability is further driving residential HVAC demand across urban and semi-urban regions.

India Commercial HVAC Systems Market

The commercial HVAC market in India is expanding rapidly with the growth of offices, shopping malls, hotels, hospitals, airports, and data centers. These facilities require large-scale, efficient HVAC systems to maintain comfort, air quality, and operational reliability. Central HVAC systems, chillers, and VRF solutions are widely used in commercial settings.

Energy efficiency, sustainability compliance, and government regulations strongly influence HVAC system selection in this segment. The expansion of IT parks, healthcare infrastructure, and organized retail continues to support strong demand for commercial HVAC systems across India.

Regional Analysis of the India HVAC Systems Market

Maharashtra HVAC Systems Market

Maharashtra represents one of the largest HVAC markets in India, driven by extensive urbanization and industrial activity. Cities such as Mumbai, Pune, and Nagpur host a large concentration of offices, IT parks, hospitals, shopping centers, and high-rise buildings. Hot and humid climatic conditions sustain year-round demand for cooling solutions, while the growth of data centers and metro projects further boosts adoption of energy-efficient HVAC systems.

Uttar Pradesh HVAC Systems Market

Uttar Pradesh is emerging as a high-potential HVAC market due to rapid urbanization and large-scale infrastructure projects. Cities such as Noida, Greater Noida, Lucknow, and Kanpur are witnessing strong growth in residential, commercial, and institutional construction. Government initiatives related to smart cities, airports, and metro rail systems are driving adoption of commercial HVAC solutions, while rising living standards support residential demand.

Andhra Pradesh and Gujarat HVAC Systems Markets

Andhra Pradesh’s HVAC market is growing with industrial expansion and urban development in cities such as Visakhapatnam, Vijayawada, and Amaravati. Manufacturing, pharmaceuticals, and food processing industries rely heavily on HVAC systems for controlled environments. Similarly, Gujarat’s strong manufacturing base, rising temperatures, and emphasis on smart city development are driving demand for energy-efficient HVAC systems across commercial and industrial sectors.

Market Segmentation Overview

By Equipment:

Heat Pump, Air Conditioning, Boilers, Air Purifier, Chillers, Air Handling Units, Unitary Heaters, Ventilation Fans, Dehumidifiers, Others

By End Use:

Residential, Commercial, Industrial

By Top States:

Maharashtra, Tamil Nadu, Karnataka, Gujarat, Uttar Pradesh, West Bengal, Rajasthan, Telangana, Andhra Pradesh, Madhya Pradesh

Competitive Landscape

The India HVAC systems market is highly competitive, featuring global and domestic manufacturers focused on innovation, energy efficiency, and localization. Key companies include Carrier Corporation, Daikin Industries, Ltd., LG Electronics, Johnson Controls, Haier Group, Havells India Ltd., Hitachi Ltd., and Fujitsu. Companies are analyzed through overviews, leadership profiles, recent developments, SWOT analysis, and revenue performance.

Conclusion

The India HVAC systems market is set for sustained growth through 2034, driven by rapid urbanization, infrastructure development, rising energy efficiency requirements, and growing awareness of indoor air quality and health. While challenges such as high costs and skill shortages persist, supportive government policies, technological advancements, and increasing adoption across residential, commercial, and industrial sectors are strengthening market fundamentals. As India continues its transition toward smart, sustainable cities, HVAC systems will remain a critical enabler of comfort, productivity, and environmental responsibility.

Discover Modern Comfort: A Guide to Apartment Rent in Beirut

Beirut, the lively capital of Lebanon, is a city that blends deep-rooted history with a mo…