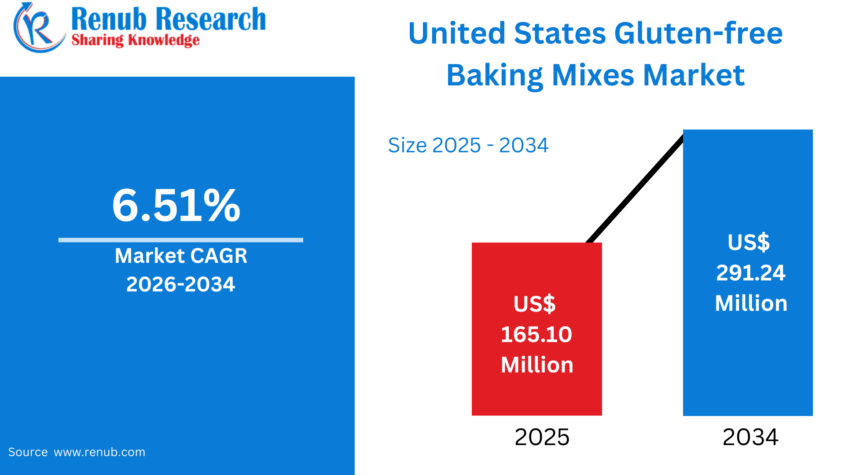

United States Gluten-free Baking Mixes Market Size and Forecast 2026–2034

According to Renub Research United States gluten-free baking mixes market is projected to experience consistent growth over the forecast period, expanding from US$ 165.10 million in 2025 to US$ 291.24 million by 2034. The market is expected to register a compound annual growth rate (CAGR) of 6.51% from 2026 to 2034, supported by increasing awareness of celiac disease, rising gluten intolerance, and the growing popularity of clean-label and wellness-oriented diets.

Once viewed as a niche category serving medically restricted consumers, gluten-free baking mixes have transitioned into a mainstream food segment in the U.S. Improvements in taste, texture, nutritional quality, and product accessibility have expanded adoption among lifestyle consumers seeking healthier, allergen-conscious, and convenient baking solutions. Growth in home baking, along with strong retail and online availability, continues to strengthen long-term market potential.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=united-states-gluten-free-baking-mixes-market-p.php

United States Gluten-free Baking Mixes Market Outlook

Gluten-free baking mixes are pre-formulated blends designed to replace traditional wheat-based baking mixes while eliminating gluten. These products are typically made from alternative flours and starches such as rice flour, almond flour, corn flour, tapioca starch, potato starch, and sorghum, combined with binding agents to replicate gluten’s functional properties.

These mixes are used to prepare a wide range of baked goods, including bread, cakes, cookies, pancakes, muffins, brownies, waffles, and pizza crusts. By removing the need to source and measure multiple gluten-free ingredients, baking mixes simplify home preparation while delivering consistent baking performance.

In the United States, gluten-free baking mixes have gained strong popularity due to increased awareness of digestive health, food sensitivities, and ingredient transparency. Beyond medical necessity, many consumers adopt gluten-free products as part of broader wellness, weight management, and clean-eating lifestyles. Improved flavor profiles, enhanced textures, and better shelf availability have positioned gluten-free baking mixes as convenient, everyday options for American households.

Growth Drivers of the United States Gluten-free Baking Mixes Market

Increasing Prevalence of Gluten Intolerance and Health Awareness

One of the most significant drivers of market growth is the increasing diagnosis and awareness of celiac disease and non-celiac gluten sensitivity in the United States. Approximately 1% of the U.S. population is affected by celiac disease, while non-celiac gluten sensitivity is estimated to impact around 6% of consumers, substantially expanding the addressable market.

In addition to medical demand, a growing number of consumers voluntarily avoid gluten due to perceived benefits related to digestion, metabolism, and inflammation reduction. Gluten-free foods are often associated with cleaner labels, improved gut health, and overall wellness. As nutrition education, medical guidance, and food labeling improve, gluten-free baking is becoming normalized in home kitchens rather than being limited to special dietary needs. Home baking also allows consumers to control ingredients, sugar levels, and allergens, further boosting demand for gluten-free baking mixes.

Home Baking Culture and Post-pandemic Lifestyle Shifts

The sustained popularity of home baking remains a key growth driver. Baking is increasingly viewed as both a convenience-oriented activity and a form of emotional wellness. Gluten-free baking mixes appeal to consumers seeking simplicity, consistency, and reduced preparation time, particularly those without expertise in gluten-free formulations.

Busy households, working professionals, and families prefer mixes that deliver reliable taste and texture without complex ingredient sourcing. Baking also plays an important role in households with children and special dietary needs, encouraging repeat purchases. Seasonal demand during holidays, celebrations, and family gatherings further strengthens sales cycles. Continued interest in home cooking ensures steady long-term demand for gluten-free baking mixes.

Product Innovation and Premiumization

Product innovation is a major force shaping market expansion. Manufacturers are focusing on improving taste, texture, nutritional content, and clean-label credentials to compete more effectively with wheat-based alternatives. Innovations include high-protein blends, ancient grains, organic ingredients, reduced sugar formulations, and allergen-free products.

Premium positioning based on non-GMO, vegan, organic, and functional nutrition claims supports higher price realization and consumer trust. Packaging innovations such as single-serve formats and family-size packs expand usage occasions. Brands are also introducing specialized mixes for bread, cookies, cakes, pancakes, brownies, and pizza crusts, encouraging category diversification. As competition intensifies, ingredient transparency and consistent baking performance will remain critical differentiators.

Challenges in the United States Gluten-free Baking Mixes Market

Higher Prices and Cost Sensitivity

Price remains a major barrier to mass-market penetration. Gluten-free baking mixes are significantly more expensive than conventional baking mixes due to higher raw material costs, specialized processing, and strict certification requirements. Ingredients such as almond flour, rice flour, and stabilizing agents increase production expenses, while dedicated gluten-free manufacturing facilities add compliance and testing costs.

Price-conscious consumers, particularly in middle- and lower-income segments, often restrict gluten-free purchases to medically necessary use. Economic uncertainty further amplifies value-driven purchasing behavior. Although private-label offerings are helping reduce prices, cost disparities remain a structural challenge affecting household penetration and repeat consumption.

Texture, Taste, and Shelf-life Limitations

Despite significant advancements, gluten-free baking mixes continue to face sensory and functional challenges. The absence of gluten affects elasticity, softness, and moisture retention, making it difficult to fully replicate the texture of traditional baked goods. Some gluten-free products are prone to dryness, crumbling, or limited flavor depth.

Shelf-life may also be shorter due to the lack of gluten’s natural binding and preservation properties. Negative first-use experiences can discourage repeat purchases and weaken brand loyalty. Manufacturers must carefully balance clean-label demands with functional additives to maintain acceptable sensory performance, often at higher costs.

United States Gluten-free Bread Market

Gluten-free bread represents the largest and most critical segment within the U.S. gluten-free baking ecosystem. As a daily dietary staple, bread alternatives are essential for consumers with gluten restrictions. Demand includes both commercially baked products and home-baked bread made using gluten-free baking mixes.

Consumers increasingly seek softer textures, longer freshness, and whole-grain nutritional profiles. Functional enhancements such as added fiber, protein, and probiotics support premium pricing. Although gluten-free bread remains one of the most technically challenging products to formulate, continuous innovation and growing consumer trust continue to support steady volume growth.

United States Gluten-free Cookies and Biscuits Market

The cookies and biscuits segment benefits from strong snacking culture, impulse purchasing, and indulgence-driven consumption. Cookies are more tolerant of gluten removal, allowing manufacturers to achieve better taste and texture consistency compared to bread products.

Gluten-free cookies are popular among children, office snackers, and adults seeking portion-controlled indulgence. Baking mixes allow consumers to customize sweetness and ingredient quality at home. Premium flavors, seasonal offerings, and chocolate-based varieties encourage repeat purchases, while gifting demand during holidays further supports growth. This segment remains one of the fastest-growing within the gluten-free baking category.

United States Gluten-free Corn Flour Baking Mixes Market

Corn flour baking mixes form a foundational segment due to corn’s natural gluten-free properties and strong consumer familiarity. These mixes are widely used for cornbread, muffins, pancakes, tortillas, and traditional American and Hispanic baked goods.

Corn flour is relatively cost-efficient compared to nut-based alternatives, making it attractive to value-oriented consumers. However, corn-based mixes can produce dense or dry textures if not properly formulated. Manufacturers continue to enhance blends with starches and binding agents to improve sensory performance. Cultural acceptance and affordability ensure continued demand for this segment.

United States Gluten-free Rice Flour Baking Mixes Market

Rice flour baking mixes are preferred for premium and versatile gluten-free formulations due to their neutral flavor, fine texture, and high digestibility. These mixes are widely used across cakes, cookies, breads, waffles, and multi-purpose baking applications.

White and brown rice flour variants enable both indulgent and health-focused positioning. While rice flour requires additional starches and gums to improve elasticity and moisture retention, its predictability and hypoallergenic profile make it especially appealing to first-time gluten-free consumers. This versatility supports steady growth across home baking and foodservice channels.

Distribution Channel Analysis

Convenience Stores

Convenience stores represent a small but growing distribution channel for gluten-free baking mixes. Shelf space is limited, restricting SKU variety, but single-serve and small-pack formats support trial purchases and emergency use. While product education remains limited, convenience stores play a role in expanding consumer exposure to gluten-free packaged baking solutions.

Online Retail

Online retail is the fastest-growing distribution channel in the U.S. gluten-free baking mixes market. E-commerce platforms offer extensive product variety, specialty formulations, bulk purchasing options, and detailed ingredient transparency. Subscription models, direct-to-consumer platforms, and repeat delivery programs strengthen demand consistency. Despite challenges related to shipping costs and freshness management, online retail remains a key growth engine.

Regional Market Insights

California Gluten-free Baking Mixes Market

California leads the U.S. market due to its health-focused population, high disposable incomes, and strong food innovation ecosystem. Demand for organic, clean-label, and premium gluten-free baking mixes is high, and the state acts as a trendsetter for product development and pricing strategies nationwide.

New York Gluten-free Baking Mixes Market

New York is a high-value, urbanized market with diverse dietary preferences and strong retail infrastructure. Demand is driven by specialty grocers, gourmet home bakers, and premium product offerings. Compact packaging and ready-to-use blends perform well in space-constrained urban households.

Texas Gluten-free Baking Mixes Market

Texas represents a fast-growing, volume-driven market supported by a large population base and expanding retail footprint. Price sensitivity is higher, making private-label and value-oriented offerings important. Suburban growth and family-oriented households support strong demand for home baking products.

Arizona Gluten-free Baking Mixes Market

Arizona shows steady growth supported by health-conscious demographics, retirees, and wellness-oriented consumers. Online retail plays a crucial role in overcoming distribution gaps, ensuring access to specialty gluten-free products despite smaller market scale.

Market Segmentation

By Product Type

- Bread

- Cookies and Biscuits

- Cakes and Muffins

- Other Gluten-free Bakery Products (Brownies)

By Flour Type

- Corn Flour

- Rice Flour

- Other Flour Types

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialist Stores

- Online Retail

- Other Distribution Channels

By State

- California

- Texas

- New York

- Florida

- Illinois

- Pennsylvania

- Ohio

- Georgia

- New Jersey

- Washington

- North Carolina

- Massachusetts

- Virginia

- Michigan

- Maryland

- Colorado

- Tennessee

- Indiana

- Arizona

- Minnesota

- Wisconsin

- Missouri

- Connecticut

- South Carolina

- Oregon

- Louisiana

- Alabama

- Kentucky

- Rest of United States

Competitive Landscape and Company Analysis

The U.S. gluten-free baking mixes market is moderately fragmented, with multinational food companies and specialty brands competing on innovation, certification, and brand trust. Key companies analyzed include General Mills Inc., Conagra Brands, Inc., Kinnikinnick Foods Inc., Williams-Sonoma Inc., Continental Mills, Inc., Partake Foods, Chebe, Naturpro, King Arthur Baking Company, Inc., and SalDoce Fine Foods.

All companies are evaluated across five viewpoints: overview, key leadership, recent developments, SWOT analysis, and revenue analysis.

Conclusion

The United States gluten-free baking mixes market is steadily transitioning from a niche health segment to a mainstream consumer category. Rising health awareness, sustained home baking culture, continuous product innovation, and expanding online retail are expected to support growth through 2034. While pricing and sensory performance remain challenges, improving formulations and increasing consumer trust will continue to drive long-term market expansion.

Discover Modern Comfort: A Guide to Apartment Rent in Beirut

Beirut, the lively capital of Lebanon, is a city that blends deep-rooted history with a mo…