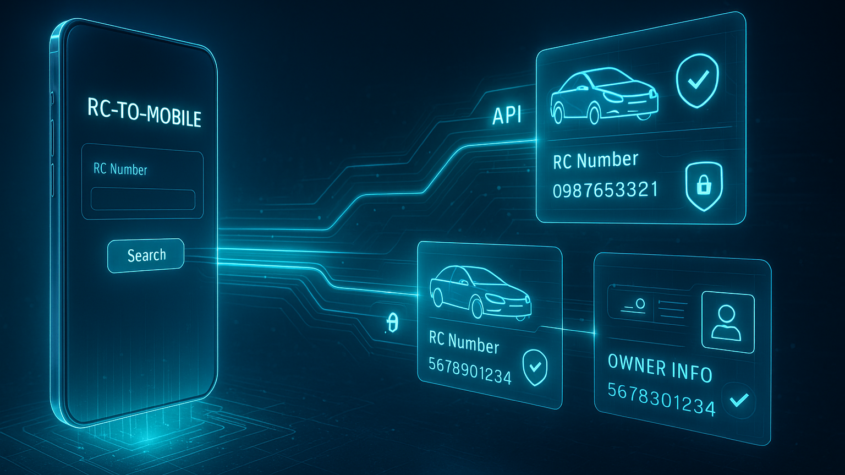

Insurance companies process a high volume of motor insurance policies every day. Each policy depends on correct vehicle and ownership data. Even a minor mismatch can delay issuance, affect renewals, or increase fraud risk. This is why insurers increasingly rely on RC to Mobile API to make policy validation faster and more dependable.

Motor insurers are shifting away from manual checks and fragmented records. Automated verification tools now play a central role in connecting vehicle records with verified mobile numbers, helping insurers maintain speed, accuracy, and trust.

What RC to Mobile Verification Means for Insurance

RC to mobile verification confirms whether a vehicle’s Registration Certificate is linked to a specific mobile number in official records. Through a vehicle RC verification API, insurers can validate this link in real time.

This process helps insurers ensure that the person requesting a policy, renewal, or claim service is genuinely connected to the vehicle. It creates a reliable verification layer between customer-provided details and verified data.

Why Policy Validation Is Often Slow

Policy validation becomes complex when insurers rely on manual document checks or inconsistent data sources. Incorrect mobile numbers, outdated ownership records, and missing RC details slow down the process.

Common challenges include delayed issuance, manual follow-ups, increased error rates, and higher fraud exposure. These issues affect both internal efficiency and customer satisfaction.

How RC to Mobile API Speeds Up Policy Validation

RC to Mobile API removes manual steps from verification workflows. Instead of relying on document uploads or calls, insurers can instantly verify RC and mobile linkage through a secure API request.

This automation reduces turnaround time and allows insurers to validate policies within seconds, even at high volumes.

Role in Motor Insurance Issuance and Renewals

During policy issuance, RC mobile number check helps insurers confirm the applicant’s association with the vehicle. This prevents incorrect policy creation and reduces correction requests later.

For renewals, verified mobile linkage ensures that reminders and renewal notices reach the correct owner. This improves renewal success rates and reduces missed communications.

Strengthening Insurance Fraud Prevention

Fraud often starts with mismatched or fake contact details. RC to Mobile API supports insurance fraud prevention by verifying mobile numbers against official RC data.

If the details do not match, insurers can flag the policy or claim for further review. This early detection helps reduce financial risk and fraudulent payouts.

Improving Underwriting Accuracy

Insurance underwriting automation depends on clean and verified data. Vehicle ownership verification through RC to Mobile API allows underwriters to rely on standardized, real-time information.

Accurate mobile linkage reduces dependency on physical documents and speeds up underwriting decisions without compromising data quality.

Supporting Claims and Endorsement Processes

Claims and endorsements require timely communication with the right vehicle owner. RC to Mobile API ensures that insurers contact the verified mobile number linked to the RC.

This reduces delays, avoids miscommunication, and helps claims teams resolve cases faster and more accurately.

Driving Operational Efficiency Through Automation

RC to Mobile API integrates smoothly with policy management and underwriting systems. It eliminates repetitive verification steps and allows teams to focus on higher-value tasks.

Automation also enables insurers to scale operations without increasing operational overhead or staffing costs.

Compliance and Data Reliability

Insurers must meet strict compliance standards related to customer verification and data accuracy. RC to Mobile API uses verified data sources, helping insurers maintain audit-ready records.

Reliable verification strengthens reporting accuracy and reduces discrepancies during regulatory checks.

Real-World Insurance Use Cases

In digital policy issuance, RC to mobile verification allows insurers to validate details instantly, avoiding manual callbacks. During claims, the same verification helps confirm claimant authenticity before proceeding.

These use cases show how RC to Mobile API improves speed while maintaining control.

Future Importance of RC to Mobile Verification

As insurance processes become fully digital, reliable verification will remain essential. RC to Mobile API will continue to support faster policy validation, cleaner data workflows, and stronger fraud control mechanisms.

Insurers adopting this approach early gain long-term operational and competitive advantages.

Conclusion

RC to Mobile API plays a critical role in modern motor insurance operations. By enabling faster policy validation, improving underwriting accuracy, and supporting insurance fraud prevention, it helps insurers deliver reliable and efficient services.

For insurance companies focused on speed, compliance, and customer trust, RC to Mobile API is a foundational part of future-ready policy workflows.

Discover Modern Comfort: A Guide to Apartment Rent in Beirut

Beirut, the lively capital of Lebanon, is a city that blends deep-rooted history with a mo…